Bonus depreciation calculator

The Tax Cuts and Jobs Act of 2017 made significant changes to both Section 179 and bonus depreciation. This federal bonus tax calculator uses supplemental tax rates to calculate withholding on special wage payments such as bonuses.

Calculate Your Tax Savings With Limited Amount Of Effort Using Bonus Depreciation Calculator Federal Income Tax Tax Reduction Income Tax Saving

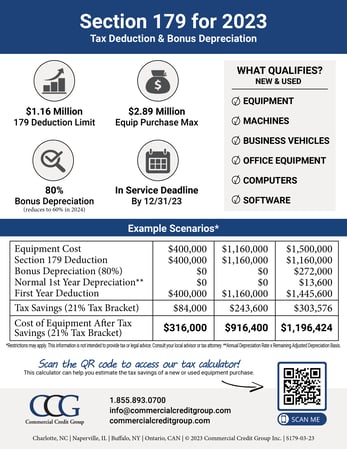

For tax years beginning in 2022 the maximum section 179 expense deduction is 1080000.

. For instance a widget-making machine is said to depreciate. Depreciation allows a business to write off the cost of an asset over its useful life or the number of years the asset will be used in the business. Qualifying businesses may deduct a significant portion up to 1080000 in 2022 to be adjusted for inflation in future years.

D i C R i. A bonus depreciation is a tax incentive that allows a business to immediately deduct a large percentage of the purchase price of eligible business assets. Section 179 deduction dollar limits.

Now you generate yourself a 250000 bonus depreciation. Adheres to IRS Pub. While the bonus depreciation calculator cant provide an exact amount of additional depreciation it provides excellent guidance on whether cost segregation makes sense for you.

Federal Bonus Tax Percent Calculator. 3 5 7 10 15 20 1 3333 4000 4286 4500 4750 4813 2 2222 1600 1224 900 475 361 3 741 960 875 720 428 334 4 370 576 625. There is a dollar-for-dollar phase out for purchases over 27.

The MACRS Depreciation Calculator uses the following basic formula. Free MACRS depreciation calculator with schedules. Where Di is the depreciation in year i.

Please explain used property as it relates to bonus depreciation. C is the original purchase price or basis of an asset. These changes continue to be in effect for 2022 and when used together may.

What is bonus depreciation. You take 100 bonus depreciation again. This limit is reduced by the amount by which the cost of.

This time you have a 250000 down payment so you can buy a 1 million property. First bonus depreciation is another name for the additional first year depreciation deduction provided by section 168 k. Then apply bonus depreciation and section 179 for items ineligible under the de minimis rules considering respective eligibility and phase-out thresholds to maximize the tax.

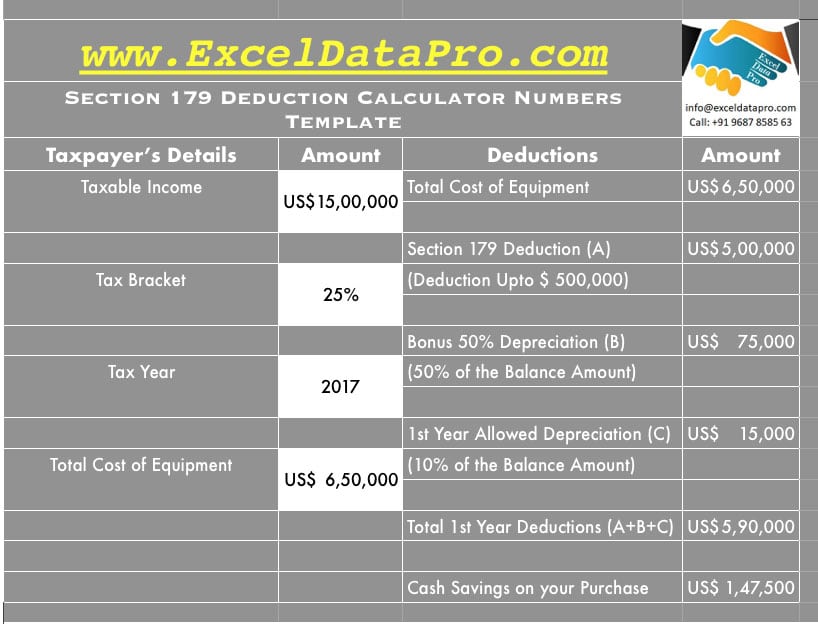

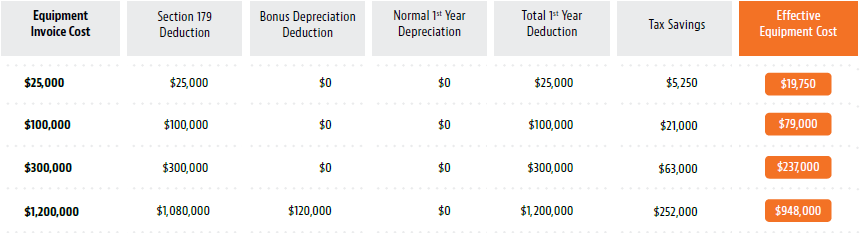

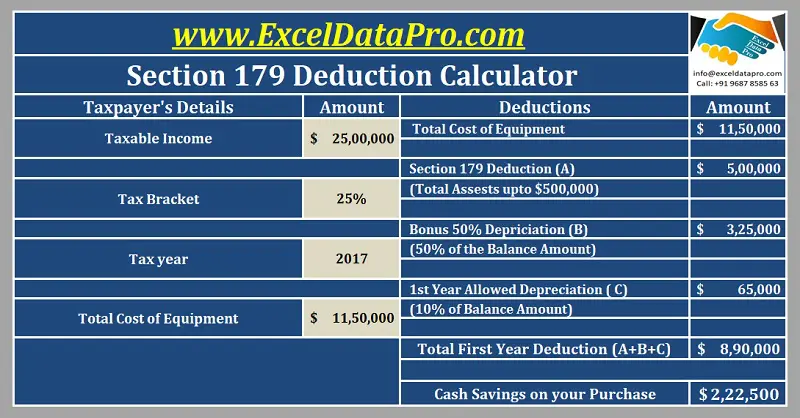

Example Calculation Using the Section 179 Calculator. Conceptually depreciation is the reduction in the value of an asset over time due to elements such as wear and tear. Using a 75000 equipment cost for a sample calculation shows how taking advantage of the Section 179 Deduction can significantly.

If your state does. Supports Qualified property vehicle maximums 100 bonus safe harbor rules.

Section 179 Bonus Depreciation Saving W Business Tax Deductions Envision Capital Group

Download Section 179 Deduction Calculator Apple Numbers Template Exceldatapro

What You Need To Know About Bonus Depreciation United Leasing Finance

Section 179 And Bonus Depreciation Changes For 2021 Jlg

Section 179 Calculator Ccg

Download Section 179 Deduction Calculator Excel Template Exceldatapro

Lic S Latest Bonus Rates For 2016 17 Work Advice Bonus How To Plan

Increase The Rate Of Return With Cost Segregation Tax Reduction Income Tax Study Help

/StraightLineBasis-bfb937d99f9d49ac9a15b8f78ca3b1a0.jpg)

Straight Line Basis Calculation Explained With Example

Section 179 Deduction Hondru Ford Of Manheim

Bellamy Strickland Commercial Truck Section 179 Deduction

Estimating Tax Savings From 100 Bonus Depreciation Semi Retired Md

What Is Zero Depreciation Or Zero Dep In Car Insurance Top 12 Real World Car Insurance Queries Answered Car Insurance Comprehensive Car Insurance Insurance

Calculate Depreciation In Excel With Sum Of Years Digits Method By Learn Learning Centers Learning Excel

Section 179 Bonus Depreciation Saving W Business Tax Deductions Envision Capital Group

Income Bonus Depreciation Department Of Taxation

Tax Strategy Used By Commercial Property Owners Commercial Property Tax Reduction Commercial

Komentar

Posting Komentar